Salary cards are an essential part of the daily routine for a lot of workers across the UAE. These cards allow you to collect monthly salaries or withdraw cash. They also help control basic expenses such as transportation, food and accommodation. For those who don’t have a bank account, the salary cards are a convenient and secure method of accessing their earnings.

The most popular pay card that is used in the UAE is the Ratibi card. A lot of workers rely upon this credit card therefore knowing how to verify the balance available at the correct time is vital. This guide explains the Ratibi check balance in a straightforward and straightforward manner, with no technical terminology. You will be taught how to determine your balance, the most common issues that you might encounter, as well as helpful tips for managing your income with confidence.

What Is a Ratibi Salary Card?

The Ratibi pay card, also known as a salary card prepaid credit card provided to employees whose employers pay their wages through appointed UAE banks. This card lets employees receive their salary without opening accounts with a personal bank. The card is able to utilize ATMs to make cash withdrawals and balance checking.

The majority of Ratibi cardholders in the UAE are managed and issued in the UAE by First Abu Dhabi Bank under the Wage Protection System. This ensures that employees get their wages promptly and in a safe manner.

The Ratibi card was intended for use in a basic way. It doesn’t offer complete banking services like checking accounts for savings, books of cheques or international transfer. For daily wage access, it’s reliable and user-friendly.

Why Ratibi Cards Are Widely Used in the UAE

It is true that the UAE has a vast number of workers from all over the world who all prefer simpler financial solutions. Ratibi cards are popular due to the fact that they don’t require complicated documentation and are easy to manage.

Employers also like salary cards as they ease the process of paying employees and allow them to conform to UAE laws on labor. The cards for employees provide security, convenience and quick access to pay without having to visit a branch of a bank.

Why Checking Your Salary Balance Is Important

Checking your balance on your salary card can help you avoid numerous problems. If you don’t check your balance, you could encounter denied withdrawals or failed transactions or unanticipated costs.

Principal reasons to keep an eye on your Ratibi balance on a regular basis are:

- Confirming that your wages have been credit

- The proper planning of monthly expenses

- To avoid ATM withdrawal problems

When you know your current balance, you are able to manage your finances with confidence and with peace of.

How to Check Ratibi Balance Using an ATM

The most commonly used and simple method of checking the balance of your pay card is to use an ATM. ATMs are readily available throughout the UAE and are open all hours of the day.

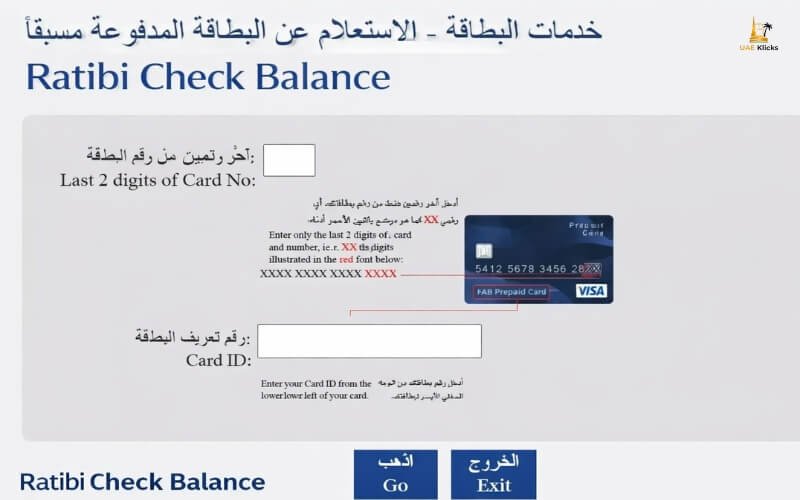

To determine your balance, just place the Ratibi credit card in the ATM and then enter your PIN. Choose the balance inquiry and your current balance will show at the top of your screen. Some ATMs permit printing the receipt that shows the balance.

This method doesn’t require internet connectivity and is appropriate for all users.

Checking Ratibi Balance Through SMS

For those who don’t have internet access or smartphones, Balance checking via SMS is an excellent option. This service lets you get your balance information directly to your mobile phone.

The SMS service can only be used in the event that your phone’s number has been associated with the institution. You might require a specific number to your bank’s registered phone number. In certain instances there may be a small fee for service that might be applied.

This is a great option if you require information quickly and can’t go to an ATM.

Bank Support for Balance Inquiry

If you’re not able to determine your balance through your ATM or SMS contact your bank for an alternative. Support staff at customer service can assist you once you have verified your identity.

Contact the helpline of your bank or go to any branch during office hours. This is particularly helpful in the event that your card is locked or damaged, or you’ve forgotten your pin.

Ratibi Balance Check Methods

| Method | What You Need | Availability |

| ATM | Card and PIN | 24/7 |

| SMS service | Registered mobile number | Limited |

| Support for banks | ID verification | Hours of operation |

Common Problems Faced by Ratibi Card Users

There are times when users face problems when checking your balance, or when using their credit card. These issues are typically short-term and are easy to resolve.

Common problems include repeatedly entering the wrong pin time, ATM network problems, or physical damage to the card. If this occurs it is recommended to seek help from the bank instead of repeatedly using the ATM.

Safety Tips for Using a Ratibi Card

Making sure your pay card is secure is crucial because it is the source of your monthly income. Simple security practices can safeguard your cash.

Important safety tips for you include:

- Do not share your PIN number with anyone else.

- Do not put your PIN on the card.

- Contact the police if you have lost or stolen your card right away

These measures help to prevent unauthorised usage and loss of money.

Difference Between Ratibi Card and Bank Account

A Ratibi card isn’t equivalent to a complete bank account. It was designed to allow access to salary and simple transactions.

A bank account can provide additional services like savings and online banking, as well as transfers of money as well as bill payments. A lot of people start out with an account with a Ratibi card, and then establish a bank account once their financial requirements increase.

Ratibi Card vs Bank Account

| Feature | Ratibi Card | Bank Account |

| Account opening | Employer-based | Individual |

| Checking balances | Methods that are limited | Multiple methods |

| Savings option | Not available | Available |

| Online services | No | Yes |

Managing Your Monthly Salary Wisely

The ability to manage money is essential for any person who uses a salary card. Because Ratibi cards typically pay the money once per month Budgeting can help you avoid being short of cash in the early days.

It’s a good practice to monitor your balance after the credit on your salary and also plan for expenses like food, rent, transportation, food, and family assistance. This will help you remain financially sound throughout the month.

Knowing Ratibi Check Balance properly allows you to plan withdrawals and reduce unnecessary stress.

UAE Rules for Salary Cards

Salary Cards in the UAE are subject to strict rules to ensure the safety of employees. Employers are obliged to pay their employees on time by authorized banks.

If you experience delays in your pay or other issues If you are experiencing issues with your salary, you have the option to speak with your employer, or seek assistance from your bank. Knowing your rights will help you make the right decisions whenever you need to.

Advantages of Using a Ratibi Salary Card

Ratibi cards provide a variety of benefits for people who require easy financial access. They are simple to utilize, widely accepted, and safe.

The card lets you pay wages without having to maintain accounts with banks This is beneficial to many employees. If you have a basic financial need this Ratibi card is an ideal solution.

Long-Term Financial Planning for Card Users

While they are helpful however, planning for the long term may require other options. As earnings increase most workers opt to create bank accounts to save and goals for the future.

Knowing how Ratibi Check Balance functions will be the very first thing you need to know to better financial management. In time, establishing solid financial habits will result in greater security and stability.

Related Article:

How to Check Salik Balance in Dubai

Abu Dhabi Bus Card Balance Check

FEWA & EtihadWE Bill Payment in UAE

NBAD Bank Balance Check Salary

Conclusion

The practice of checking your balance on your credit card often is a basic but vital routine. With the availability of ATMs, SMS services and bank support, customers from the UAE are able to easily keep informed about their balances. If you know how to utilize the Ratibi card in a safe manner, prepare expenditures carefully and be aware of when you should seek assistance to control your income in peace. Integrating balance checks into your routine will allow you to avoid financial problems and remain financially safe.

Frequently Asked Questions

Do I have the ability to verify my Ratibi balance without internet access?

Yes it is possible to check the balance with either an ATM and SMS services.

Are there any fees to check Ratibi balance?

ATM check-ins for balance are generally cost-free, while SMS services can come with some charges.

What do you do when my pay isn’t creditable?

First, contact your employer Then contact bank support when you need.

Can I utilize the Ratibi Card at ATMs located in the UAE?

Yes, the majority of Ratibi cards are compatible with the major ATM networks.

What can I do to protect my Ratibi card?

Secure your PIN and report stolen or lost cards as soon as you notice it.

Leave a Reply