Making money more efficient starts with being aware of your balance at the right moment. As digital banking becomes the trend in the banking industry, determining your FAB balance on your account is never easier. If you prefer to use the mobile device, an ATM or even an online portal for checking your bank balance, a fantastic request can be made with just a few steps or clicks.

Why You Should Regularly Do a FAB Bank Balance Enquiry

Making a FAB Bank Balance Enquiry is among the most crucial financial habits that you can establish. It’s not about just being aware of the amount of money available, but also staying in the know and avoiding any unwanted surprise costs.

Here’s why checking your balance regularly is crucial:

- Stay informed about the funds you have available.

- Helps identify fraudulent or suspicious transactions in the early stages.

- Helps with the process of budgeting and planning for future expenses.

- Confirms that the salary or payment have been credited at the correct time.

- It reduces the risk of overdrawing your bank account.

Maintaining a consistent checking of your balance at the bank allows you to make educated choices, avoid penalties and help you manage your savings better.

How to Check Your FAB Bank Balance

There are a variety of options to conduct your fantastic balance check. No matter if you’re a tech expert or prefer to use traditional methods, the bank provides a range of options to access your account in a secure way.

Mobile Banking App

Its FAB Mobile Banking app provides the simplest and fastest way to see your balance.

Methods to check balance via the app:

- Get the Official FAB mobile app from the app store.

- Log in with the username you created and your password.

- Provide any additional verification details in case you are asked (like the OTP).

- After you have logged into your account, click”Accounts.” Once you’re logged in, go to the “Accounts” section.

- Your balance, as well as your transaction history will appear in the primary screen.

- After that, log out securely to safeguard your account.

The advantages of using the mobile app are:

- Instant access at any time, from any location.

- All accounts are visible on one dashboard.

- Receive push notifications about the transfer of salary credits or other transactions.

- Transfer money to pay bills or look over spending all in one location.

The mobile app provides complete control of your finances in your pocket, which makes it the choice of the majority of customers.

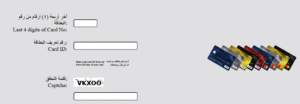

Online Banking (Website Portal)

If you prefer either a laptop or computer the FAB’s online banking portal is another option.

Check your balance on the internet:

- Visit this site to access the fab balance check online portal.

- Log in using your credentials (username, password along with the verification number).

- Click on the Accounts section.

- Review your current balance, the balance that is available, as well as the transaction summary.

- Download your statements if you require a thorough outline.

- Log off when you are done to protect yourself.

Benefits of online banking are:

- It is accessible from laptops and desktops.

- Complete breakdowns of transactions.

- The ability to handle multiple accounts at the same time.

- Additional features like utility payments and transfer of funds.

Checking Balance at an ATM

If you’re in the city you can always go to the closest ATM FAB.

The steps to take for ATM balance inquiry:

- Insist your debit or prepay card in the ATM.

- You must enter your personal identification number.

- Choose Balance Inquiry from the menu.

- Check your balances available and current from the dashboard.

- You could print a mini report or receipt if you want.

- Check your credit card prior to leaving.

The reason it’s beneficial:

- Ideal For those preferring banking with a physical device.

- Quick and always available.

- You don’t need an internet connection.

ATM banking is a good option for those who want fast and immediate access to their cash.

SMS Banking

FAB’s SMS banking service is an excellent tool for instant access to banking without the internet.

Check balance with SMS:

- Verify that your number on the mobile is associated with FAB’s banking SMS service.

- Send a message in the proper formatting (for an example): “BAL [last 4 digits of account]” ]”).

- Make the message available via the company’s official FAB number.

- You’ll get an instant SMS that will show your balance.

Why SMS banking is beneficial:

- Does not require internet connection or application installation.

- Ideal for travel or in areas that aren’t connected.

- Gives you instant information whenever you require it.

Phone Banking Customer Service

You can also verify your balance by contacting customer service.

Check your balance by telephone:

- Make a call to the FAB Customer Service number.

- Enter your account number and confirmation details.

- After verification the representative will be able to share the balance of your account.

When should you use phone banking:

- If you’re not able to connect to online or mobile services, you may be unable to access online or mobile.

- If you have any questions regarding recent transactions.

- For further assistance regarding your account.

Checking Salary and Transaction Details

There are times when you need to confirm that your salary or other payment has been properly credited. Here’s how to check:

- Log into the FAB app or your online banking.

- Go to Transaction History or Account Activity.

- Find entries that have transfer of funds or salary deposits.

- You can also sort transactions by date or type to help you see the details.

This ensures that your payments remain on time and that no delay are missed.

Understanding Balance Types

In the course of your fabulous balance check, you could find different terms, such as “Available Balance” and “Current Balance.”

What do they mean?

- Available Balance Amount of money you have available for utilize in the immediate future.

- Current Balance: Contains all transactions that are pending (like holds or deposits that are due in the near future).

If you’ve ever seen an error message such as New Balance 530 it indicates your new balance that you have after the transaction.

Security Tips for Balance Checking

Mobile and online banking are safe, however users must always be cautious. Be sure to follow these important tips:

- Make sure to use only authorized apps and portals when login.

- Never ever share passwords, PINs or OTPs with anyone.

- Do not use public Wi-Fi while using an account at a bank.

- Always log out following a check of your balance.

- Create the biometric authentication (fingerprint or facial ID) for quicker and more secure access.

- Update your contact details so that you are able to receive OTPs and alerts.

- Monitor for suspicious activity on a regular basis and report any suspicious activity immediately.

If you adhere to these suggestions to follow, you can make sure that your financial details secure when doing any balance inquiry.

Extra Services You Can Access While Checking Your Balance

FAB banks aren’t restricted to the checking of your balance. They also let you do:

- Pay your bills (utilities telephone credit card).

- Move funds from one account to another.

- Control prepaid cards.

- Update your personal information.

- Request statement of account.

In addition, when you are controlling your money, you may consider it useful to conduct an etisalat balance check in order to monitor your mobile recharges and mobile recharges side-by-side.

Common Problems During Balance Enquiry

| Issue | Possible Solution |

| Unable to log in | Set your password and try another device. |

| App does not show the balance | Check your app for updates and the internet connectivity. |

| SMS not received | Check that your phone’s number has been correctly registered. |

| ATM is not showing balance | Contact another ATM or customer service. |

| Balance update delayed | Take a moment to think about it for transactions to take a few minutes to reflect. |

| Suspicious deduction | You must immediately report it to your bank so they can block the card. |

Understanding these issues will help you solve them quickly, without fear.

Related Article: FAB Bank balance check Easy ways

Benefits of Using FAB Digital Banking

Customers today have a wealth of advantages of digital banking. A few of the benefits are:

- Access at any time, anyplace.

- Quick and user-friendly interfaces.

- Payment gateways that are secure.

- Fast notifications and updates.

- Reduces time and reduces branch visits.

With these tools, managing your account will be smooth and easy.

Conclusion

A fantastic bank balance inquiry is simple, quick and crucial for keeping your financial sense. With options that are digital, such as mobile banking and SMS, web portals, ATMs, ATMs and customer support You can access your account at any time you want.

If you’re aware and adhere to security guidelines, you’ll always be in control of your financial situation. Checking your balance isn’t just an everyday routine, it’s a sensible way to keep your funds in a safe place and helps you plan your budget accurately.

FAQs

What is the best time to conduct an inquiry into my balance?

You can review your balance whenever you like. It’s recommended to look it over each week or at the end of significant transactions to ensure better management.

How can I verify my balance without having an internet connection?

Yes, you are able to use SMS or go to an ATM to check your balance.

Are there any fees to check the balance?

Mobile, online, or ATM check balances are typically free. However, certain international and SMS-based inquiries may be charged a small amount.

What should I do if the balance appears to be off?

Examine your transactions first. If the issue persists you can contact customer support to get clarification.

Do I have access to multiple accounts from one application?

It is true that FAB lets you manage several accounts through the same login.

Leave a Reply